On the surface, we are told that “all is well in dodge city”, with the usual stuffed suit cast of characters rustling their prize winning financial shenanigans cattle from one summit to the next, apparently without stopping to water their horses, or oil their saddles. But the stark reality is that the cattle are getting seriously restless, to the point of stampede, for those at the sharp end of their steel capped “fiscal compact” riding boots.

As of writing, the jury remains out on whether the Greek Bond Vigilante gang will roll over quietly and drink their proverbial milk, or ride noisily into town, shoot the Sheriff and his deputies, clerks and other minor officials of the EU gravy train, blow up the “fiscal restructuring” express and let all the cattle loose to trample the fools who bought into the bums-rush-to-economic-suicide pact of last week. If we wake up tomorrow to steaming piles of cow manure, we will know that the sovereign default circus has come to town, to finally tip this economic dustbowl on the edge of sanity over the cliff.

If reports that both Germany and Switzerland are urgently inventorying their worldwide gold holdings, with a view to imminent demands of repatriation, are correct, then we are on the verge of very major developments. To the uninitiated the central banking cartel, led by the NY Fed, are the hoarders of the vast majority of world physical gold, which underpins the role of the US dollar as world reserve currency. For national governments to even hint at challenging the status quo in this area is a sign of potential imminent, fundamental changes in the global financial architecture.

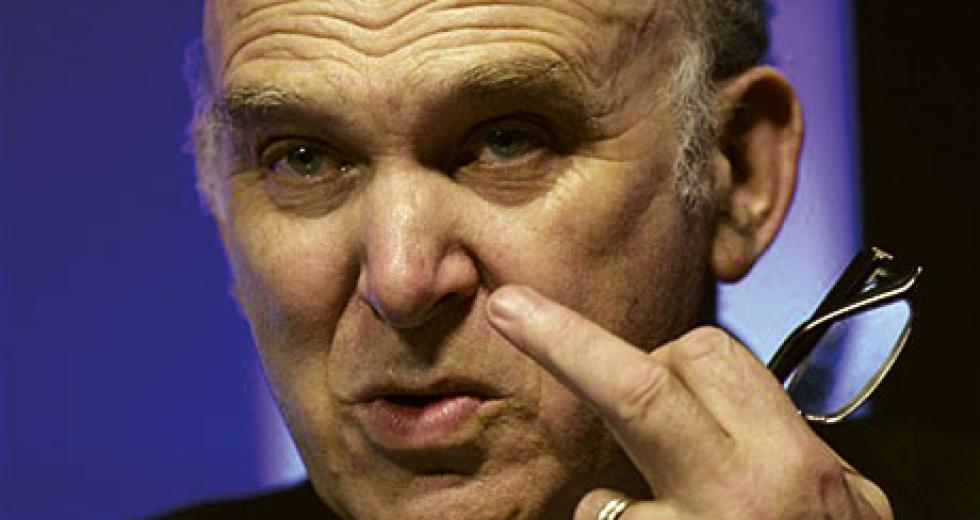

Meanwhile, in the wake his leaked “Help! Is anyone actually driving this bus?” internal memo, Lord Vincent de “bumbling ineffectual” Cable (government minister for economic mismanagement), has firmly cemented his bumbling credentials this week. We can only conclude that his fellow cabinet ministers, first and foremost the Chancellor himself, are equally clueless about what is going on in the country as their particular medicinal brand of “cut everything to the bone and hope for the best” free market radicalism medicine, despite liberal and copious administering, is having little to no effect on the barely twitching corpse of UK PLC.

It should come as no surprise to anyone, at least, anyone who does not have an economics PhD, that pumping more debt into a bankrupt banking system will generally not result in an increase in productive economic activity, unless and until the black hole sitting on the balance sheets of the banks to which you are lending, is forcibly removed into a “bad bank” and left to rot for the creditors who think they actually own a share of the worthless “assets” so described. To Mr Cable’s credit, he does recommend the breakup of RBS as being “long overdue”. We could not agree more. Our only criticism of his proposals in this regard would be: *why stop there?*

It is interesting, and encouraging, that his memo refers to the “lack of economic vision”, and the need for a “long term planning” approach to economic policy. We have long since said that we are way past the point where “Austrian school” monetarist orthodoxy can be relied upon to fix the convergence of systemic economic calamities that face this nation. So if Vince is serious about his concerns in this area, he can make a start by dumping the notion that money has intrinsic value, and begin to look at public credit and national infrastructure investment as a means to raise the entire platform of the physical economy, as the only meaningful way of addressing what is now the inescapable reality of our collective national bankruptcy.

To summarise: The Greenback Pound and the Lawful Bank are the only solutions to this mess we have created for ourselves.

It certainly beats the “managed decline” tactics of class warfare that we have been subjected to this week, as the government pathetically attempts to persuade us that low income families deserve credit for their children, but middle income families do not. Divide and conquer only works when the people haven’t read your “rules for radicals” playbook, so our advice would be to stop yanking that particular chain, Mr Osborne, we know your game Sonny Jim!